Incentives

Businesses locating or expanding here may be eligible for specific local and state financial incentives. Falls City Economic Development and Growth Enterprise (EDGE) can assist you with identifying and understanding the programs that best meet your company’s growth needs and guide you through the financial assistance application process.

Nebraska's New Generation of Economic Development Incentives

The Nebraska Advantage package was designed to create a business climate that makes Nebraska the preferred business location and rewards businesses that invest in the state and create new jobs.. In this progressive, pro-business tax climate, corporate income and sales taxes are reduced or virtually eliminated.

The Nebraska Advantage package was designed to create a business climate that makes Nebraska the preferred business location and rewards businesses that invest in the state and create new jobs.. In this progressive, pro-business tax climate, corporate income and sales taxes are reduced or virtually eliminated.

The Nebraska Advantage package benefits businesses with:

- Investment credits

- Wage credits

- Sales tax refund

- Customized job training

- State and local sales tax exemptions for purchases of manufacturing machinery, equipment and related services

- Research and development tax credits

- Microenterprise tax credits

- Inventory tax exemptions

For more information on the Nebraska Advantage package, go to the Nebraska Department of Economic Development's (NEDED) website.

Employee Training Incentives

Customized Job Training Advantage

The Nebraska Advantage incentive package also provides a flexible and discretionary job training program with grants from $500 to $4,000 per qualified new job. You can design your own training, or a statewide training team can assist with training needs and assessments, training plans, curriculum development and training instruction. For more information of the program, go to NEDED's website.

Nebraska Worker Training Program

Nebraska Worker Training Program

This program makes funding available to businesses for retraining and upgrading existing employees. Use of program funds is extremely flexible. The type and length of training programs, training vendors and materials are chosen by the company. For more information on the program, visit the Nebraska Department of Labor’s website.

Talent and Innovation Initiative

One of the most important accomplishments of the recently concluded legislative session was the passage of several bills signed into law in May, 2011, focused on creating new momentum for developing and attracting businesses rooted in technology and innovation—Talent and Innovation Initiative. Follow the links below to the Nebraska Department of Economic Development's website for more information on each program.

- Intern Nebraska Program: Creates new internship opportunities for college and university students to gain job experience working with companies across the state. The program went into effect on June 1, 2011. For program information and applications, click here. The paid internship portal can be found at InternNE.com.

- Angel Investment Tax Credit: Encourages investment in high-tech and other startup Nebraska enterprises by helping attract private funding. The tax credit is refundable and available to a wide range of industries making Nebraska's Angel Investment Tax Credit one of the most competitive in the nation. The program went into effect on August 10, 2011. For program information and applications, click here.

- Site and Building Development Fund: Increases industrial and commercial sites available and ready for business development. The program went into effect on October 3, 2011. For program information and applications, click here.

- Business Innovation Act: Provides funding to help businesses develop new technologies that lead to quality job opportunities across the state. Competitive grants will provide funding and technical assistance for research at Nebraska institutions, new product development and testing, and help expand small business and entrepreneur outreach efforts. The program went into effect on October 1, 2011. For program information and applications, click here.

For more information on the Talent and Innovation Initiative, go to the NEDED's website.

Nebraska Teleworker Job Creation Act

The Nebraska Teleworker Job Creation Act, which was signed into law on April 7, 2010, grants Nebraska companies tax credits for offering teleworker jobs to Nebraskans in eligible areas, including Falls City/Richardson County. Falls City's advanced Fiber-to-the-Home Network makes us a smart location for at-home workers. Under the bill, companies could qualify for reimbursement for training expenses of up to $300 per worker. Read more about the Act in articles featured in the Lincoln Journal Star and Omaha World Herald.

Tax Increment Financing (TIF)

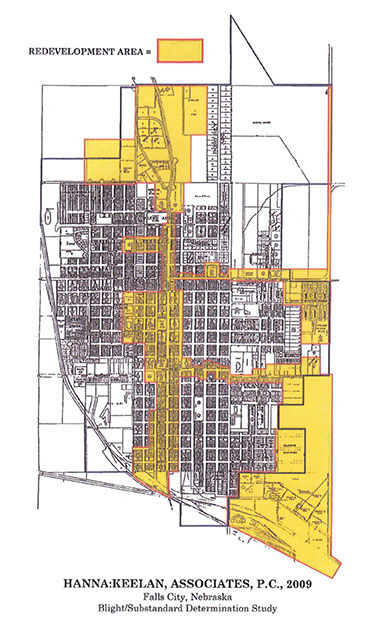

Tax increment financing (TIF) is a method of financing public improvements associated with a private development project in redeveloping substandard and blighted areas by using the projected increase in the property tax revenue resulting from the private development. This tax revenue increase is used to pay for the public improvements or is pledged to repay bonds issued by the local government or loans used to finance these improvements. In effect, TIF can reduce developer capitalization to a level that makes investment feasible. Revenue bonds can be issued to finance all or part of a site's public pre-construction improvements. Public improvements include land purchase, clearance and sale, construction of streets, sidewalks, utilities, parks or other similar public spaces necessary in site preparation. As the map illustrates, the Falls City Redevelopment Area contains an estimated 62 acres, equal to an estimated 38% of the incorporated area of the City. (Click on map to enlarge.) For more information:

Tax increment financing (TIF) is a method of financing public improvements associated with a private development project in redeveloping substandard and blighted areas by using the projected increase in the property tax revenue resulting from the private development. This tax revenue increase is used to pay for the public improvements or is pledged to repay bonds issued by the local government or loans used to finance these improvements. In effect, TIF can reduce developer capitalization to a level that makes investment feasible. Revenue bonds can be issued to finance all or part of a site's public pre-construction improvements. Public improvements include land purchase, clearance and sale, construction of streets, sidewalks, utilities, parks or other similar public spaces necessary in site preparation. As the map illustrates, the Falls City Redevelopment Area contains an estimated 62 acres, equal to an estimated 38% of the incorporated area of the City. (Click on map to enlarge.) For more information:

- View Falls City Tax Increment Financing Program Brochure

- View City of Falls City/Community Redevelopment Authority Request for TIF Financing application

Community Development Block Grant Program

The Community Development Block Grant Program (CDBG) is administered through the NEDED and is designed to create quality jobs and promote new investments. Funds are awarded to local governments to finance programs that accomplish these goals. CDBG funds must be used to benefit low to moderate income persons, aid in the prevention or elimination of slums or blight or meet other community development emergency needs. CDBG funding can be used to purchase machinery, equipment and inventory, meet working capital needs, develop community infrastructure, construct or renovate existing buildings and real estate. In 2008 Falls City was awarded $350,000 in CDBG funding to assist Vantec, Inc. with locating its custom injection molding operation in Falls City. To learn more about program, go to the NEDED website.

Industrial Development Revenue Bonds

Industrial Development Revenue Bonds (IDRB) are issued by the Nebraska Investment Finance Authority (NIFA) or the City of Falls City to finance manufacturing or processing projects of up to $10 million. Retail, non-manufacturing, commercial and service projects are not eligible. Bond proceeds may be used to acquire land, construct new facilities, purchase and rehabilitate existing facilities and purchase new machinery. The rate of interest on the bonds is normally lower than on most loans. EDGE will proactively assist businesses with obtaining industrial development bond funding that meets the needs of the business. Visit NIFA's website for IDRB Frequently Asked Questions.

Additional performance-based tax and financial incentives may be available to qualified businesses who choose to locate or expand their business in Falls City/Richardson County. For more information on incentives and/or a customized proposal based on your business growth needs, please contact us. All inquiries will be handled confidentially.