Incentives

Businesses locating or expanding here may be eligible for specific local and state financial incentives. Falls City Economic Development and Growth Enterprise (EDGE) can assist you with identifying and understanding the programs that best meet your company’s growth needs and guide you through the financial assistance application process.

Small Business Gap Fund

Falls City Economic Development and Growth Enterprise, Inc. (EDGE) has established the Small Business Gap Fund to assist start-ups and other small businesses with financing that may not be available from banking institutions to assist covering operational and equipment purchases. The loan is often offered at lower interested rates to be paid back over a one to 5-year period.

Small Business Gap Fund Application

Asset Modernization Grant

Falls City Economic Development and Growth Enterprise, Inc. (EDGE) has established the Richardson County Asset Modernization Initiative, offering "modernization" resources to for-profit Richardson County businesses, including but not limited to manufacturers and agricultural/food product processors. The Initiative is intended to stimulate modernization of assets by County businesses.

- Offers a 5% rebate up to $25,000 for modernizing company assets.

- Small Business Category: 5 or less full-time employees with minimum investment of $20,000.

- Large Business Category: 6 or more full-time employees with minimum investment of $50,000.

- Eligible applicants must be a member of EDGE or Chamber of Commerce.

- Eligible businesses may collect an additional 1% for each full-time employee (FTE) created, up to 5% for 5 FTEs.

- Maximum total rebate per eligible applicant is 10% with creation of an average of 5 FTEs.

- Print and complete pages 14-17 in link below to apply.

Asset Modernization Grant Application

State of Nebraska Incentives

Nebraska’s business initiatives and incentive programs are designed to meet the needs of expanding and re-locating businesses. For more information on incentives, go to the Nebraska Department of Economic Development's (NDED) Incentive Programs website.

Initiatives

Our grant programs are designed to remove barriers in starting, retaining, and expanding businesses in Nebraska. Whether it involves specialized training for your employees or providing funding for site and product development, the Department of Economic Development is proud to be a partner in your success. We are here, equipped and ready, to assist you in developing and capitalizing on economic development opportunities. For more information on initiatives, go to the Nebraska Department of Economic Development's (NDED) Business Initiatives website.

Business Development

This can be the hardest part of business. Sustainable growth, taking your success story to the next level—call it what you want. We can help you get there with programs and services designed to help you grow at a healthy rate. And we’ll work alongside you so your company harvests the benefits. Because when you grow, the state grows. Have a look. For more information on development opportunities, go to the Nebraska Department of Economic Development's (NDED) Business Development website.

Tax Increment Financing (TIF)

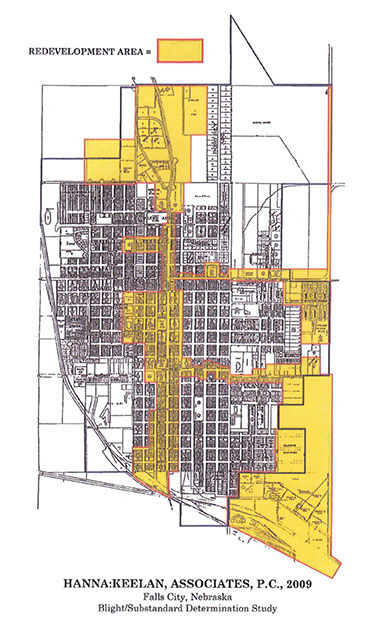

Tax increment financing (TIF) is a method of financing public improvements associated with a private development project in redeveloping substandard and blighted areas by using the projected increase in the property tax revenue resulting from the private development. This tax revenue increase is used to pay for the public improvements or is pledged to repay bonds issued by the local government or loans used to finance these improvements. In effect, TIF can reduce developer capitalization to a level that makes investment feasible. Revenue bonds can be issued to finance all or part of a site's public pre-construction improvements. Public improvements include land purchase, clearance and sale, construction of streets, sidewalks, utilities, parks or other similar public spaces necessary in site preparation. As the map illustrates, the Falls City Redevelopment Area contains an estimated 62 acres, equal to an estimated 38% of the incorporated area of the City. (Click on map to enlarge.) For more information:

Tax increment financing (TIF) is a method of financing public improvements associated with a private development project in redeveloping substandard and blighted areas by using the projected increase in the property tax revenue resulting from the private development. This tax revenue increase is used to pay for the public improvements or is pledged to repay bonds issued by the local government or loans used to finance these improvements. In effect, TIF can reduce developer capitalization to a level that makes investment feasible. Revenue bonds can be issued to finance all or part of a site's public pre-construction improvements. Public improvements include land purchase, clearance and sale, construction of streets, sidewalks, utilities, parks or other similar public spaces necessary in site preparation. As the map illustrates, the Falls City Redevelopment Area contains an estimated 62 acres, equal to an estimated 38% of the incorporated area of the City. (Click on map to enlarge.) For more information:

- View Falls City Tax Increment Financing Program Brochure

- View City of Falls City/Community Redevelopment Authority Request for TIF Financing application

Community Development Block Grant Program

The Community Development Block Grant Program (CDBG) is administered through the NDED and is designed to create quality jobs and promote new investments. Funds are awarded to local governments to finance programs that accomplish these goals. CDBG funds must be used to benefit low to moderate income persons, aid in the prevention or elimination of slums or blight or meet other community development emergency needs. CDBG funding can be used to purchase machinery, equipment and inventory, meet working capital needs, develop community infrastructure, construct or renovate existing buildings and real estate. In 2008 Falls City was awarded $350,000 in CDBG funding to assist Vantec, Inc. with locating its custom injection molding operation in Falls City. To learn more about program, go to the NDED website.

Industrial Development Revenue Bonds

Industrial Development Revenue Bonds (IDRB) are issued by the Nebraska Investment Finance Authority (NIFA) or the City of Falls City to finance manufacturing or processing projects of up to $10 million. Retail, non-manufacturing, commercial and service projects are not eligible. Bond proceeds may be used to acquire land, construct new facilities, purchase and rehabilitate existing facilities and purchase new machinery. The rate of interest on the bonds is normally lower than on most loans. EDGE will proactively assist businesses with obtaining industrial development bond funding that meets the needs of the business. Visit NIFA's website for IDRB Frequently Asked Questions.

Additional performance-based tax and financial incentives may be available to qualified businesses who choose to locate or expand their business in Falls City/Richardson County. For more information on incentives and/or a customized proposal based on your business growth needs, please contact us. All inquiries will be handled confidentially.